On-Demand Pay allows employees to access their income as they earn it. By rewarding hard work instantly, you incentivise shift uptake and lower staff turnover. This significantly reduces the need for expensive agency staff.

- No impact on cashflow ✔

- No impact on payroll ✔

- Works with all systems ✔

- Only two weeks of set up ✔

Level FT’s financial wellbeing app also includes: payroll savings, income-based budgeting, and an AI financial helper.

The platform is entirely debt-free, simple for employees to use and has a proven business impact with up to:

- 49% lower staff turnover

- 62% fewer unfilled shifts

- 51% reduction in agency costs

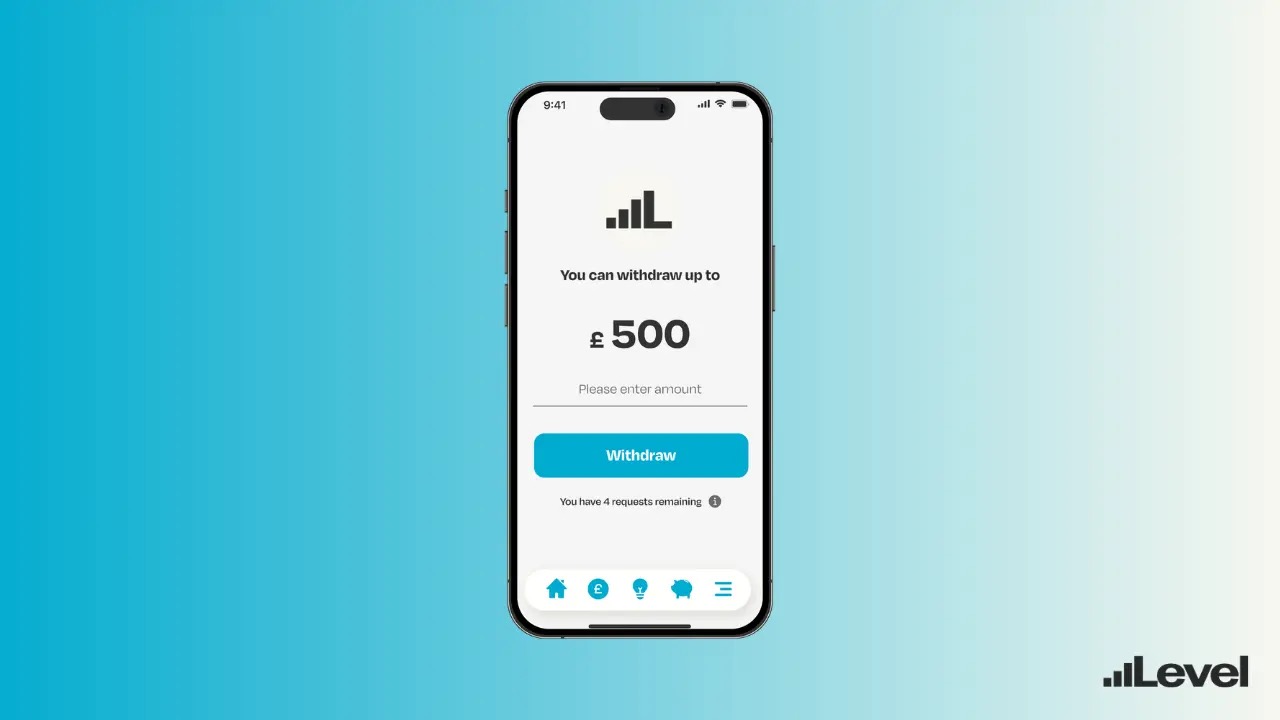

Earned Wage Access, also known as On-Demand Pay, allows employees to access their earned income before payday for an ATM-style fee. Rewarding hard work more quickly provides a debt-free alternative to payday loans and incentives people to take on more shifts.

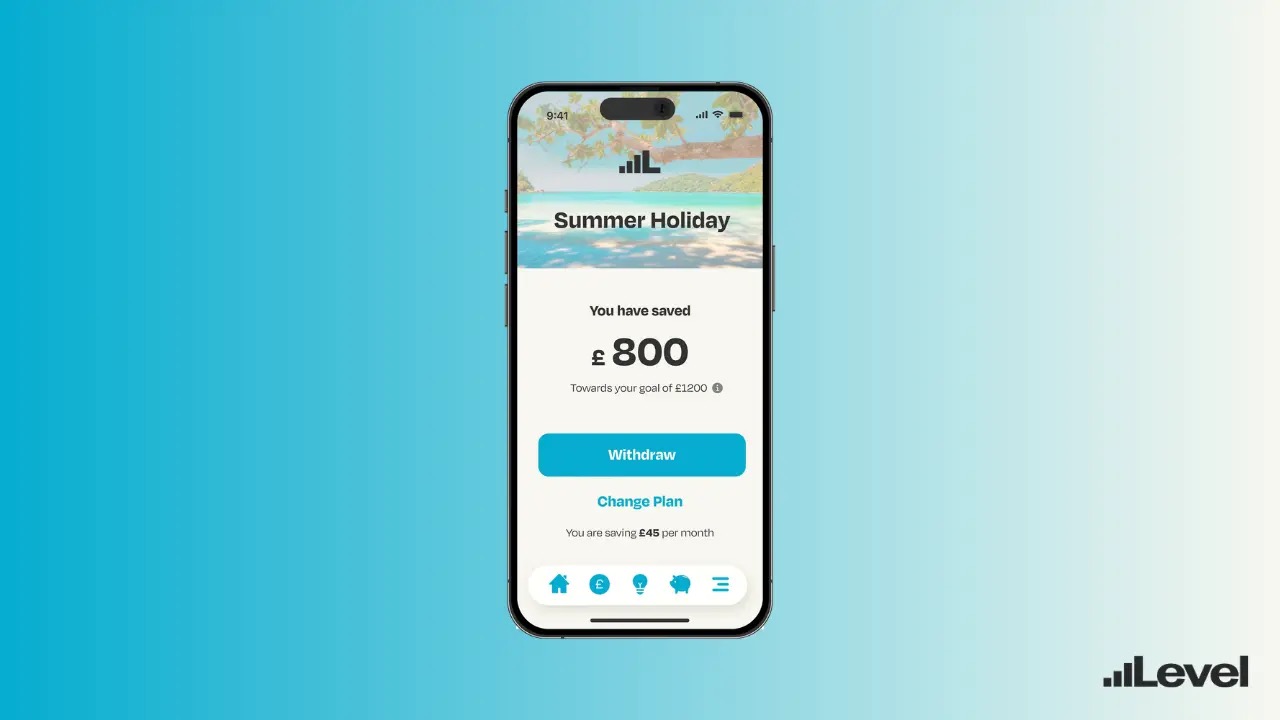

Support employees with an automated, high-interest savings tool that helps them prepare for a rainy day. Fully protected by the UK government under the Financial Services Compensation Scheme and free-to-use for employees.

Put an AI finance chatbot in every employee’s pocket. Trained exclusively on official government guidance, it is available 24/7 and powered by a UK-specific, custom-trained AI model.

Bringing income and spending data together, unlocks powerful new budgeting tools that help people understand the amount they can spend each day to meet their financial goals.